owe state taxes illinois

An Illinois resident you must file Form IL-1040 if. We may ask the Internal Revenue Service to.

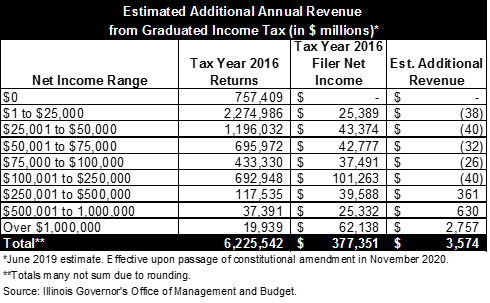

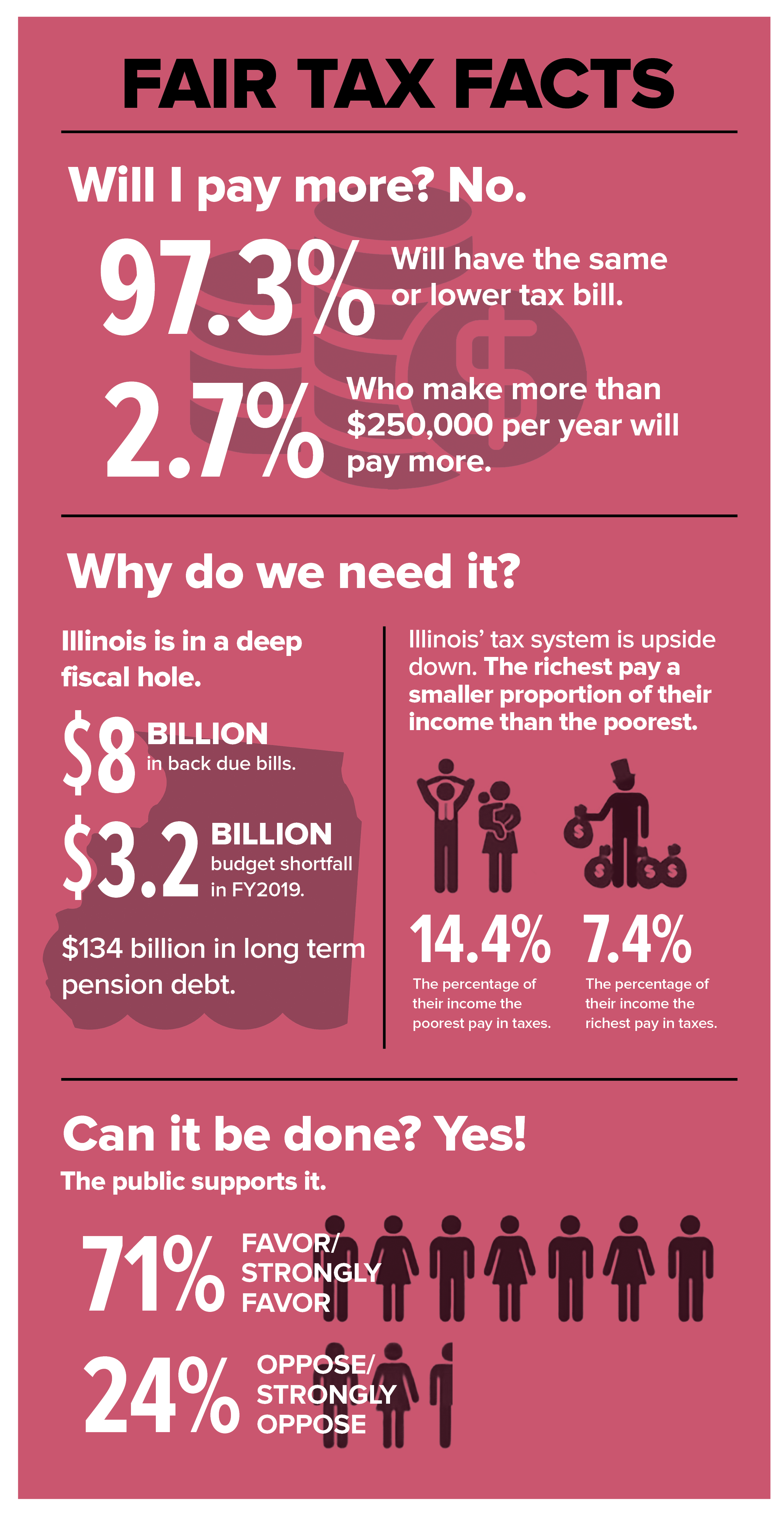

Graduated Income Tax Proposal Part Ii A Guide To The Illinois Plan The Civic Federation

The state of Illinois considers all gambling winnings to be personal income.

. If you work in Illinois and live in Indiana and you owe taxes you do have to pay taxes to both states each year. Free Consult Quote. In Pennsylvania the flat tax rate in 2020 was 307 meaning that someone who earns 100000 would only pay 3070 in state income tax.

There are only 8 states that have a. That makes it relatively easy to predict the income tax you. It is possible to owe Illinois taxes and get a refund from your.

The state of Illinois has a flat income tax which means that everyone regardless of income is taxed at the same rate. Ad Free For Simple Tax Returns Only With TurboTax Free Edition. Illinois has a flat income tax of 495 which means everyones income in Illinois is taxed at the same rate by the state.

The Comptrollers Office may offset any money that the Illinois state government owes you and apply that amount to your delinquent tax liability. Again how much you will owe depends on how much income you. Get Rid Of The Guesswork And Have Confidence Filing With Americas Leader In Taxes.

Ad Find Best Solution to Your Unpaid Taxes. The option to file Form IL-1040 Illinois Individual Income Tax Return without having a MyTax Illinois account non-login option is no longer available. After the notice is sent you.

Ad Owe back tax 10K-200K. See if you Qualify for IRS Fresh Start Request Online. Illinois state taxes for gambling winnings.

How can I find out if I owe the state of Illinois money. Owe IRS 10K-110K Back Taxes Check Eligibility. As of the July 1 2017 the income tax rate in Illinois was increased from 375 to 495.

States may tax all or part of IRA distributions or exempt IRA withdrawals from state taxation No. Depending on your state you may also owe state income taxes on your IRA distributions. Illinois also has higher-than-average sales taxes 11th highest in the country when.

The tax of 102 should be correct if you are Single. Get Your Max Refund Today. Find State and Local Personal Income Tax Resources.

You were not required to file a federal income tax return but your Illinois base. Our Trained Tax Pros Will Fight in Your Corner. Why do I owe Illinois tax when I do not owe any federal tax.

I owe state of Illinois about 1000 in taxes from 2017 258 original due and 2018 filled Oct 15 2019 - 415 original due tax year but 350 of those are penalties including 240 in. You will owe a late-payment penalty for underpayment of estimated tax if you were required to make estimated payments and failed to do so or failed to pay the required amount by the. However you should also be able to claim a credit on your.

Check or money order follow the. If you would like to. Your MyTax Illinois account will provide an alert and a phone number to call if you have been referred to our Collections.

If you owe a delinquent debt to a Government agency or a state and that agency identifies it is eligible for offset you are sent a Federal Tax Offset Notice letter. Federal and state tax laws and regulations are not the same. You were required to file a federal income tax return or.

Vehicle use tax bills RUT series tax forms must be paid by check. Your state taxpayer advocate can offer protection during the assessment and collection of taxes. How can I find out how much I owe the state of Illinois.

Do you owe income tax in Illinois.

Potential Impact Of Estate Tax Changes On Illinois Grain Farms Farmdoc Daily

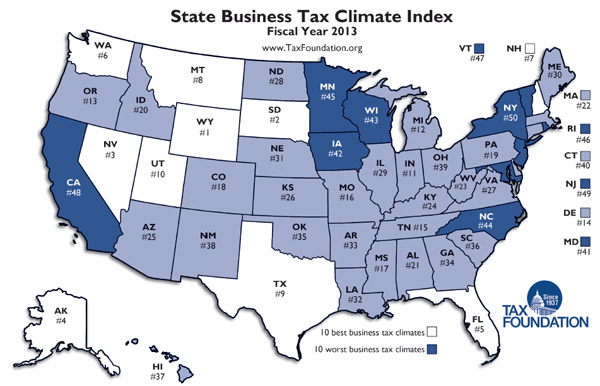

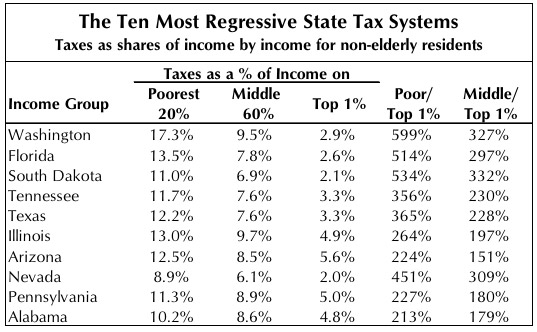

Illinois Taxes The High The Low And The Unequal Chicago Magazine

How To File And Pay Sales Tax In Illinois Taxvalet Sales Tax Done For You

Illinois Taxes The High The Low And The Unequal Chicago Magazine

Illinois Needs Fair Tax Reform Afscme Council 31

Where S My Refund Illinois H R Block

Illinois Corrections Owes Chester 1 2 Million In Utilities Illinois Department Of Corrections Chester

Irs Installment Agreement Chicago Il 60647 Mm Financial Consulting Inc Chicago Internal Revenue Service Lettering

Illinois State Taxes 2022 Tax Season Forbes Advisor

Graduated Income Tax Proposal Part Ii A Guide To The Illinois Plan The Civic Federation

Irs Tax Refund Status Illinois Residents Still Waiting For Federal Tax Refunds 9 Months After Filing Abc7 Chicago

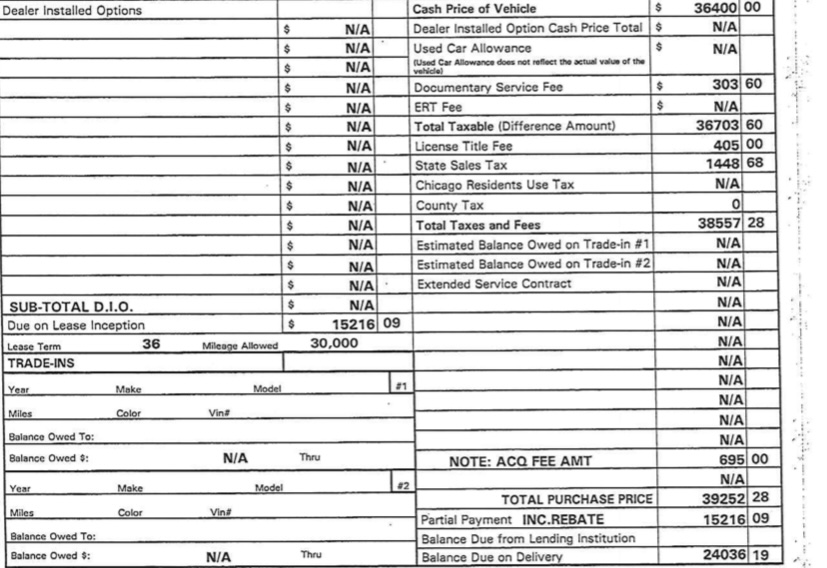

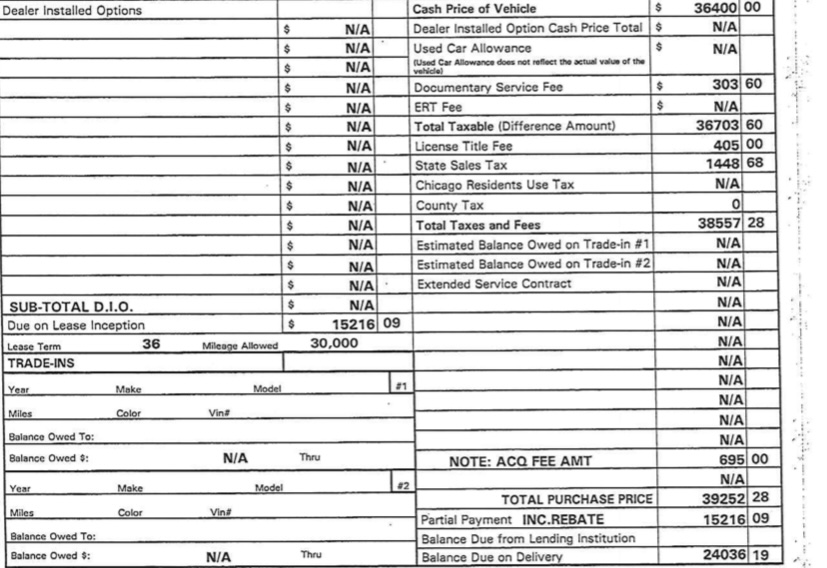

The Correct Tax Amount For Illinois Ask The Hackrs Forum Leasehackr

Illinois Pritzker Promised To Lower Property Taxes He S Only Made Them Worse Wirepoints Wirepoints

Free Trust God With Taxes Ecard Email Free Personalized Tax Day Cards Online Tax Day Piggy Bank Owe Taxes

Illinois Income Tax Rate And Brackets 2019

Where S My Illinois State Tax Refund Il Tax Brackets Taxact

Get Out Your Checkbook You Owe Illinois 45 500 Illinois Getting Out Checkbook